Welcome,

I'm Jeremy. I teach everyday people how to ...

Gain Financial Freedom With Life Insurance

Learn simple strategies guaranteed to help you...

Build Guaranteed Wealth for Retirement

Eliminate Debt Without Strict Budgeting

Protect Your Lifestyle From the Unexpected

Create an Immediate, Tax-Free Legacy

Do You Want Financial Freedom?

An Insured Wealth Strategy provides you with everything you need to

achieve financial well-being and peace-of-mind.

Wealth

Building

Debt

Elimination

Lifestyle

Protection

Legacy

Creation

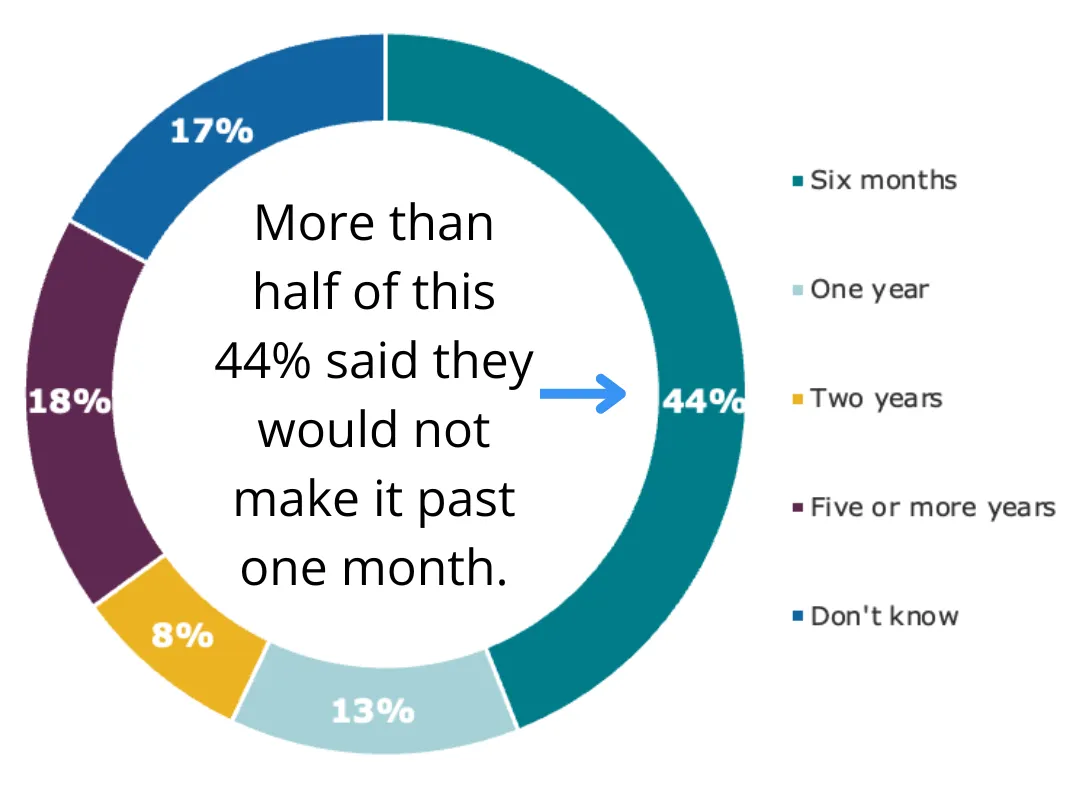

44% of American households would face financial hardship within 6 months after the loss of a primary wage earner.

Source: 2022 Insurance Barometer Study by LIMRA

How Does An Insured Wealth Strategy Work?

An Insured Wealth Strategy uses the cash value component of permanent life insurance to help improve your financial well-being and provide financial protection for

your loved ones when you pass away.

Identify Areas of Need

Step 1 is to get a clear picture of your current financial situation. From there, we identify areas where money you're already spending, usually from overpayment of debts or services you're no longer using, can be redirected to fund your policy.

Create an Immediate Legacy

Once your policy is in force, if you pass away or get sick, there is guaranteed immediate money paid to you or your family, income tax-free, that can be used to replace income, pay debt, fund education, or anything else you need the money for.

Earn Guaranteed Cash Accrual

When you contribute to your policy each month, a portion of that money earns guaranteed interest for you. As the interest grows and compounds, your overall cash value increases much faster than a traditional savings account.

Pay off Debt in Record Time

You'll continue to make the minimum payments on your debts. Once the cash value equals one of your debt balances, you'll take out a tax-free loan against your policy to pay off that debt. Because it's a loan, it doesn't affect your recognized cash value or slow continued growth.

$1.5 Million

Amount the average American, aged 35-54 old will need to retire comfortably

- (Source: USAToday 2024)

$10,000

Amount the majority of Americans, aged 35-54 have

saved for retirement

- (Source: GOBankingRates, 2023)

How Is An Insured Wealth Strategy Different From Traditional Savings & Investing?

Tax Benefits

No Taxes While Saving: The money in your life insurance policy can grow without paying taxes on it every year.

No Taxes When You Take Money Out: You can take money out of your policy without having to pay taxes, as long as you follow the rules.

Tax-Free Money for Your Family: If something happens to you, your family gets the life insurance money without having to pay taxes on it.

Easy Access to Money

Borrow Without Penalties: You can borrow money from your life insurance whenever you need it, without extra fees, even if you’re young. And, you get to decide when and how to pay it back.

Get Dividends: If you have a whole life policy that earns dividends, you can choose to take those dividends in cash or use them to pay premiums or buy more coverage.

Partial Withdrawals or Surrenders: You can also take part of the money (called “surrendering” some of the cash value) if you need it, though this might lower your death benefit.

Safe and Steady Growth

Guaranteed Savings: The money in your policy grows at a steady rate, so it’s safer than investing in the stock market, where you can lose money.

No Limit to How Much You Can Contribute: You can put as much money as you want into your life insurance policy, without any limits.

Not Affected by the Market: Your savings are not directly affected by the ups and downs of the stock market, so it’s more predictable.

Help for Emergencies

Immediate Money for Your Loved Ones: Life insurance pays an immediate amount of money to your family when you’re gone, helping them with things like bills or college.

Use for Medical Needs: You can use your life insurance money early if you get very sick, without losing all your benefits.

Two in One: Life insurance helps you save money while also protecting your family if something happens to you.

Case Study

Meet the Moores

Devon and Anna are married with two young children. Just like many families today, they are struggling with debt and uncertain about their financial future.

An Insured Wealth Strategy helped them...

Secure a life insurance plan with a death benefit to protect their family.

Implement a strategy to pay off their debt within 15 years.

Position themselves to build wealth for retirement.

Now, they can confidently face the future, knowing they are on the right path.

FAQs About Insured Wealth Strategies

Question 1: How can you help me?

I help individuals and small business owners protect their financial futures through life insurance and annuity products. I offer free strategies to grow wealth, pay off debt, leave a tax-free legacy, and protect against financial risks while providing customized financial solutions like Indexed Universal Life Insurance (IUL), Fixed Indexed Annuities, and more.

Question 2: Is there a fee for your services?

There is no fee for my consulting services. I get paid a commission from the life insurance companies when your policy is approved.

Question 3: How can life insurance help me pay off debt?

Permanent life insurance can help you pay off debt by accumulating cash value over time. This cash value grows tax-deferred and can be accessed through policy loans or withdrawals. You can use these funds to pay off high-interest debts, such as credit cards, student loans, or a mortgage, without triggering taxes or penalties. Additionally, the death benefit from a life insurance policy can provide financial support to your family by covering outstanding debts in the event of your passing, ensuring they aren’t burdened with those obligations.

Question 4: How can life insurance help me grow my wealth?

Life insurance can help you accumulate cash value over time. This cash value grows tax-deferred and can be accessed for important life events, such as retirement, emergencies, or paying off debts, without incurring penalties like other retirement accounts.

Question 5: How do I access my policy's cash value?

Policy Loans: You can borrow against the cash value of your policy. The loan is tax-free and doesn’t require repayment, but any unpaid loans will reduce the death benefit your beneficiaries receive. Interest will accumulate on the loan balance.

Withdrawals: You can make partial withdrawals from the cash value. Withdrawals may be tax-free up to the amount you’ve paid in premiums (your cost basis). However, withdrawals beyond that may be taxed, and they could reduce the policy’s death benefit.

Surrendering the Policy: If you no longer need the coverage, you can surrender the policy entirely and receive the accumulated cash value, minus any surrender charges. However, surrendering cancels the policy and ends the death benefit.